FIRST US BANCSHARES (FUSB)·Q4 2025 Earnings Summary

First US Bancshares Q4 2025: Net Income Up 10% as Credit Quality Strengthens

January 28, 2026 · by Fintool AI Agent

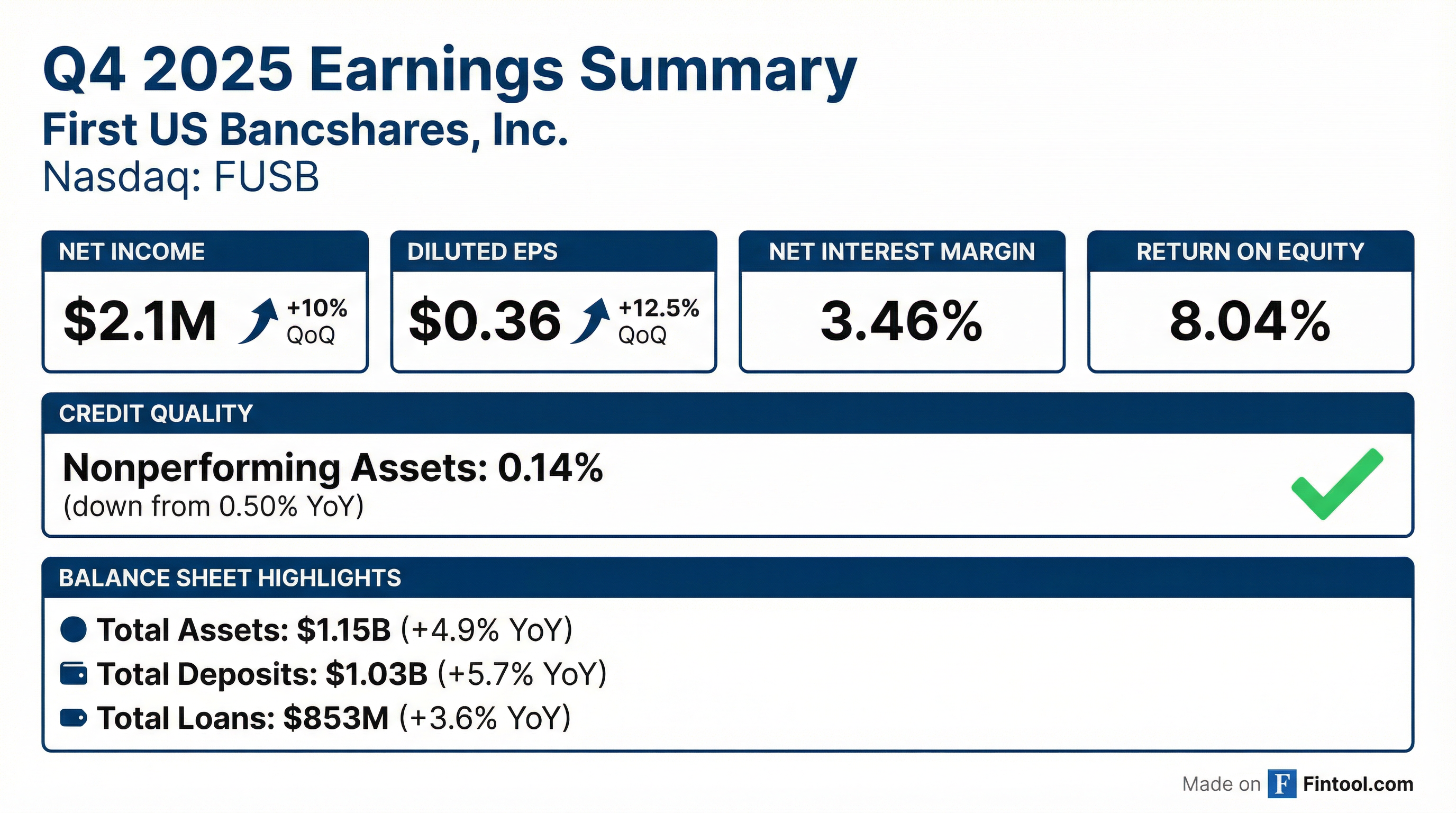

First US Bancshares (NASDAQ: FUSB) closed out 2025 on a strong note, reporting Q4 net income of $2.1 million ($0.36 diluted EPS) — a 10% improvement from Q3 2025 and 24% gain year-over-year. The Alabama-based community bank highlighted substantial credit quality improvement and continued momentum heading into 2026.

Did First US Bancshares Beat Expectations?

As a small-cap community bank with a market cap of approximately $84 million, First US Bancshares does not have active Wall Street analyst coverage for consensus estimates. However, sequential performance shows clear improvement:

The Q2 2025 dip was a one-time event driven by $2.7 million in credit loss provisions related to consumer indirect loan growth and two individually evaluated commercial loans. Both issues were substantially resolved by Q3 2025.

Full Year 2025: Net income totaled $6.0 million ($1.00 diluted EPS), down from $8.2 million ($1.33 diluted EPS) in 2024, entirely attributable to the elevated Q2 provision.

What Changed From Last Quarter?

Credit quality improved materially:

- Nonperforming assets dropped to 0.14% of total assets, down from 0.19% in Q3 and 0.50% a year ago

- Net charge-offs fell to 0.08% annualized vs 0.61% in Q3 and 0.24% in Q4 2024

- The two problem commercial loans flagged in Q2 were substantially resolved

Provision for credit losses normalized:

- Q4 provision: $0.2 million vs $0.6 million in Q3 and $2.7 million in Q2

- ACL ratio of 1.25% of loans, essentially flat YoY

Net interest margin compressed slightly:

- NIM of 3.46% vs 3.60% in Q3, though up from 3.41% YoY

- Reflects prevailing rate environment and competitive deposit pressure

How Did the Stock React?

FUSB shares have rallied 36% over the past year, rising from around $10.60 in early 2024 to $14.49 currently. Key stock metrics:

The stock is trading near its 52-week high, reflecting improved investor confidence following the credit quality turnaround.

What Did Management Say?

CEO James F. House struck an optimistic tone:

"We are pleased to conclude 2025 with a quarter of continued strong earnings growth. Fourth quarter net income improved by 10% compared to the prior quarter and 24% compared to the fourth quarter of 2024. In addition, we saw continued improvement in loan portfolio credit metrics, with substantial decreases in both net charge-offs and nonperforming assets."

"While 2025 was a challenging year, particularly related to credit issues that were largely resolved by the third quarter, we have continued to build momentum and are excited about the Company's prospects for 2026."

Balance Sheet Highlights

Loan portfolio composition as of Q4 2025:

- Consumer indirect: $382M (45%) — boats, RVs, trailers with avg credit score 783

- Commercial real estate: $201M (24%)

- Multi-family residential: $118M (14%)

- 1-4 family residential: $67M (8%)

- C&I: $48M (6%)

- Construction: $33M (4%)

Capital and Liquidity

The Bank maintains strong capital ratios above "well-capitalized" thresholds:

Liquidity position: Total readily available liquidity of $467.2 million, up from $397.7 million YoY.

Capital Allocation

Dividends: Declared $0.07/share quarterly dividend, totaling $0.28 for 2025 vs $0.22 in 2024 — a 27% increase.

Share Repurchases: Completed 128,000 shares at weighted average $13.76/share in 2025. Expanded authorization by 1 million shares in Q4; 1.78 million shares remain available.

Forward Catalysts

-

New market expansion: Banking center in Daphne, Alabama (Mobile area) expected to open H1 2026 — first deposit-gathering facility in this market

-

Continued credit normalization: Management expects credit metrics to remain favorable as problem loans have been resolved

-

Consumer indirect growth: High-credit-score lending platform (avg FICO 797 on new originations) provides growth runway

Risks to Watch

- Net interest margin pressure: NIM compressed 14 bps QoQ amid competitive deposit environment

- Economic uncertainty: Management flagged inflation, unemployment, tariffs, and consumer affordability as ongoing concerns

- Rate sensitivity: Acquired brokered deposits with interest rate derivatives to hedge rate exposure

Key Takeaways

- Q4 delivered: 10% QoQ and 24% YoY net income growth with strong EPS improvement

- Credit turnaround complete: NPAs at 0.14% and charge-offs normalized after Q2 spike

- Capital strength: Well-capitalized with growing book value and active buyback

- 2026 setup: Management "excited about prospects" with new market expansion underway

Data sourced from First US Bancshares 8-K filed January 28, 2026.